28 | The Lion King

UBA Hosts

Social Media

Summit for

Nigerian

Journalists

U

BA recently hosted more

than 130 journalists in

Nigeria to a one day

summit on Functional Social

Networking. It was one of the

largest gatherings of senior

journalists in Nigeria with

representations from both

traditional print and electronic

media as well as from the New

Media community.

Also present were academics

and students from the top

journalism schools in Nigeria

including; the School of Media

and Communication at the Pan

Atlantic University, the University

of Lagos, as well as from Caleb

University and Lagos Polytechnic.

GMD/CEO, Mr. Phillips Oduoza in

the opening remarks, highlighted

the “disruptive changes” going

on in the media space globally

while noting the attendant

opportunities for innovative

media companies to excel.

The aim of the summit was to

make journalists more social-

media friendly and savvy, and

also improve the understanding

of media owners of the social

media space and how to take

advantage of it.

Dr. Yinka Adedeji, Divisional

Head, e-banking also made

a presentation on the bank’s

e-banking offerings.

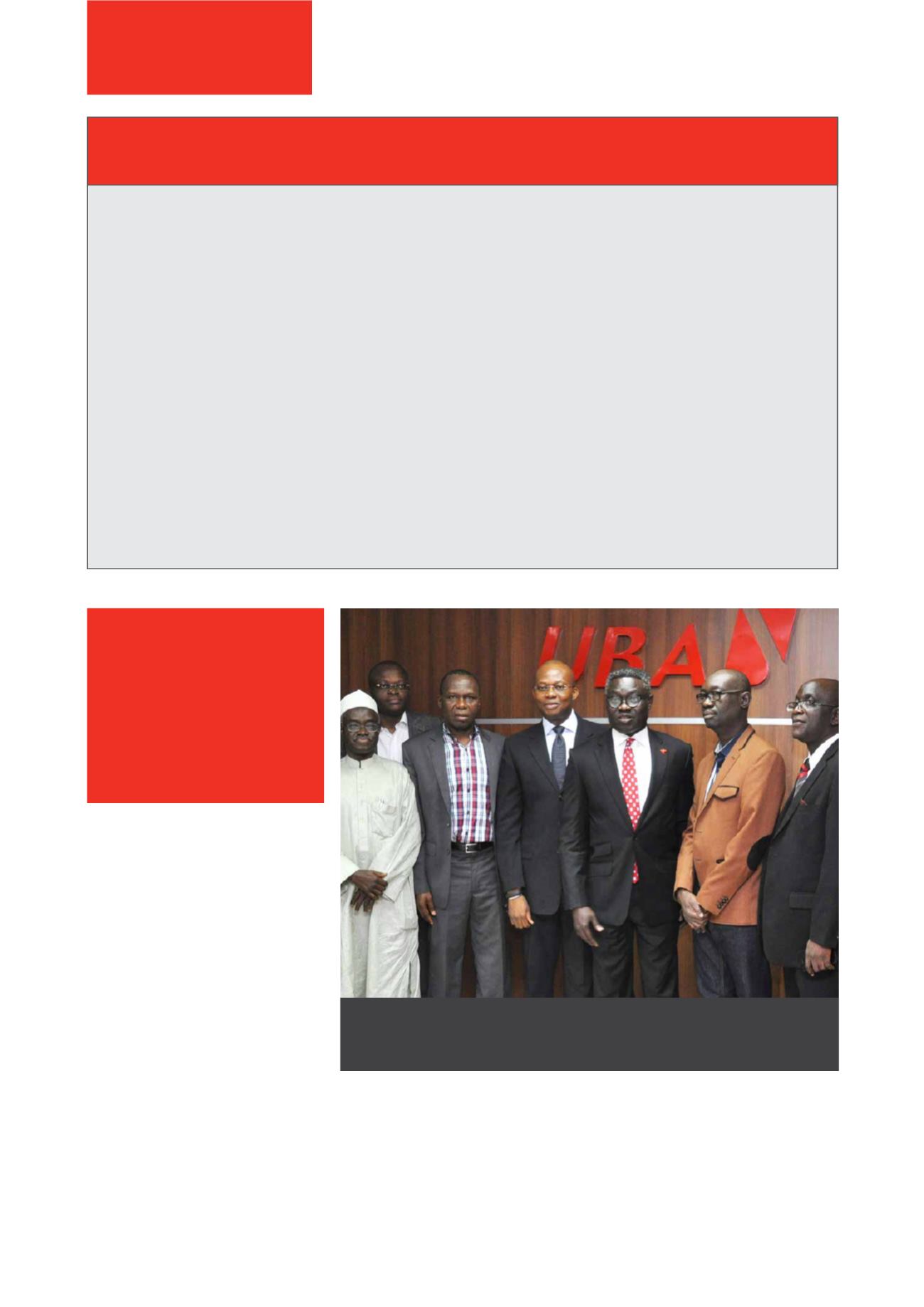

GMD/CEO, UBA Plc, Mr. Phillips Oduoza (5th left); flanked from left by Ace Columnist, Alhaji

Mohammed Haruna; MD, Leaders and Company, Mr. Eniola Bello; Former Managing

Director, Sun Publications , Mr. Tony Onyima; DMD, Mr. Kennedy Uzoka; Special Adviser to

Lagos State Governor on ICT, Mr. Lateef Raji; and Editor-in-Chief, Vanguard Newspapers,

Mr. Gbenga Adefaye, at the Summit on Functional Social Networking for Nigeria Journalists

JP Morgan Remains Bullish on UBA

A

nalysts at the global

investment banking

giant, JP Morgan, have

identified UBA Plc as one of

most attractive banking stocks.

In its equity research report for

Central and Eastern Europe,

Middle East and Africa

(CEEMEA) titled “Nigerian

Banks: thoughts around policy

action on the CRR”, the United

States of America (USA)-based

investment powerhouse stated

that UBA, under the current

industry scenario is among its

top most “favoured banking

stocks”

In the report, which followed

the move by the Monetary

Policy Committee (MPC) of the

Central Bank of Nigeria (CBN),

to hike the Cash Reserve Ratio

(CRR) of public institutions

deposits, from 50 percent to 75

per cent, JP Morgan noted that

the policy would impact the

bottom line of banks but less

so for United Bank for Africa in

2014.

Also analysts at BPI Capital

have commended the bank’s

low risk lending strategy noting

that over 60% of UBA loan book

is geared toward corporates,

which makes its loan book

relatively low risk. The bank’s

2013 full year results shows that

Non-Performing loans ratio has

dropped at an industry low of

1.19%, one of the lowest in the

African banking industry.

The bank was also able to

improve another significant

index as cost-to-income ratio

dropped to a low of 60.9% in

full 2013 from 64.8% in full year

2014.

The full year results shows a

profit before tax of N56 billion

in 2013, representing a 7.08%

increase over the N52 billion

profit before tax in 2012. The

bank also closed the year with

a total assets of N2.64 trillion,

an increase of 16.23% over the

N2.27 trillion in 2012 while total

equity increase by 22.1% to

N235 billion.

News Round Up