When a Greek man is at the tipping point, the usual slogan is “Quo Vadis”. In the Chinese parlance, it is “Ni

Qu NaLi”, which connotatively means “where do we go from here”. The past three quarters of the year have

been indeed challenging for African countries and the near term prospect looks very bleak.

July - September 2015 •

The Lion King

• 11

By Abiola Rasaq

All eyes on China;

Ni Qu Nali?

W

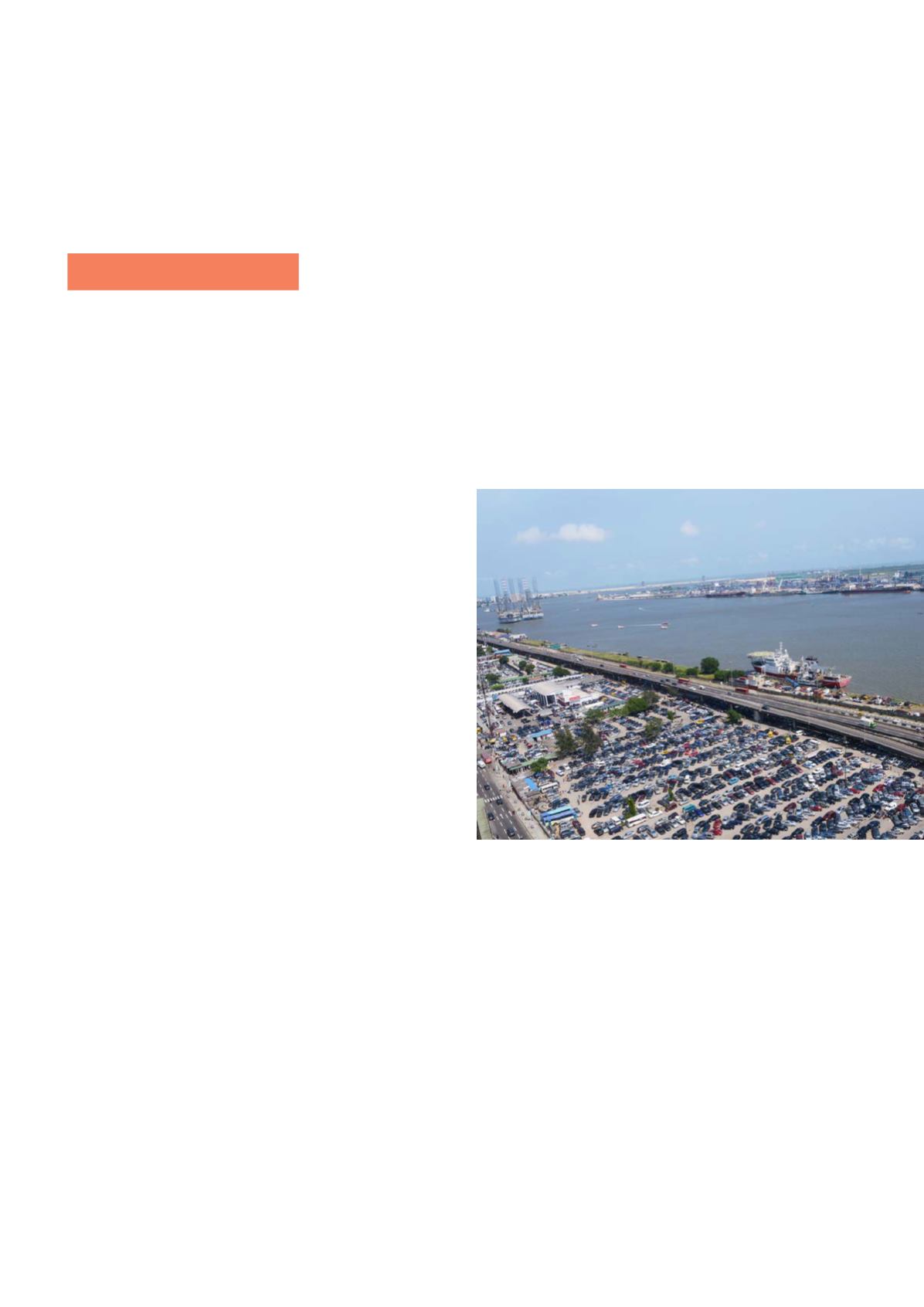

hilst noting the domestic challenges of insecurity,

energy crisis, weak fiscal position and high pub-

lic debt overhang in the African economies; the

contagious impact of global “economic stagnation” is tak-

ing notable toll on African economies. Even as increased

integration of the African economies into the global market

has a positive impact on growth, the overwhelming depen-

dence of African countries on China and a few developed

countries increasingly exposes Africa to external shocks,

particularly in the form of lower commodity prices, weak

financial flows and moderated grants and aids.

After an impressive feat in the last two decades, the

Chinese economy is slowing down, with the GDP growth

taking a breather to sub-7.5%, the lowest level in almost 20

years. Further reinforcing the slow growth number and sug-

gesting weaker demand for raw materials (i.e. basic com-

modities, which are the major exports of African countries) is

the weak PMI, which settled at a six-year low in September.

The slowdown in China may further dent the prospect of

output growth in a number of African countries, especially

for countries like Angola and Zambia which rely on China

for some 50% and 30% of their exports respectively. More

concerning is the decision of the policy authority in China

to devalue the Yuan by 2%, with signals of further devalu-

ation if need be, as the policy makers hope to strengthen

the Chinese export market and weaken capital outflows; a

decision which may put more pressure on African countries.

Whilst the Federal Open Market Committee (FOMC)

remained dovish at its September meeting, leaving U.S.

benchmark interest rate at near zero level, concerns over

likely interest rate hike in the last quarter of the year may

prolong the pressure on African currencies, especially as

protracted weakness in commodity prices suggests a long

haul for the recovery of African currencies. Interestingly,

elevated interest rates in African markets (monetary policy

rate stands at 24%, 13% and 11.5% in Ghana, Nigeria and

Kenya respectively), which are aimed at stabilizing the local

currencies to minimize imported inflationary pressures on

the highly import dependent African economies, is increas-

ingly hurting output growth. African economies like Nigeria

is a typical case study, with GDP growth outlook of 2.6% in

the year and downside risk of sliding into recession by 2016,

if requisite fiscal and monetary measures are not taken to

stimulate economic activities.

There is a market consensus that commodity prices will

remain weak over the next quarter, a challenge for African

economies, given the long-aged reliance on commodity

exports. Whether or not the Federal Reserve in the U.S. hike

interest rate, African currencies will see further pressure,

with attendant implication for imported inflation. Monetary

policies will remain tight as policy makers struggle to defend

local currencies and battle inflation pressures. Pathetically,

the government of most African economies are in poor fis-

cal positions and thus may remain relatively “helpless” as

the global and domestic shocks hit their economies.

Where do African countries go from here? Most macro-

economic variables suggest a challenging quarter ahead,

but painful fiscal consolidation and requisite reforms may

change the continent’s fortune, with the prospect of rede-

fining Africa’s place and role in the global market. It will be

a long haul but improving democracy/governance, better

resource management and increasing number of quality

human capital should help achieve the required change

in Africa…this will require some short term pains, which per-

haps are inevitable prices to pay for future gains.

Q4 Outlook

|

Business