United Bank for Africa (UBA) Plc released its audited financial results for the first half of the year ending

June 2015 beating the expectations of financial analysts.

10 •

The Lion King

• July - September 2015

T

he results, released September 03, 2015, show strong

growth in earnings and profits, as the Bank continued

to benefit from its determination to provide value to

its large customer base in Nigeria, and across Africa. The

results also show that the bank’s increasingly important pan

African network, now contributes over 23% of profit after tax.

Significant improvement was also recorded in operational

efficiency even as the bank maintained a healthy loan

book, a tribute to both its risk management and to the

robustness of its clients’ businesses, with non-performing ratio

at just 1.8% of total loans granted, one of the lowest in the

banking industry.

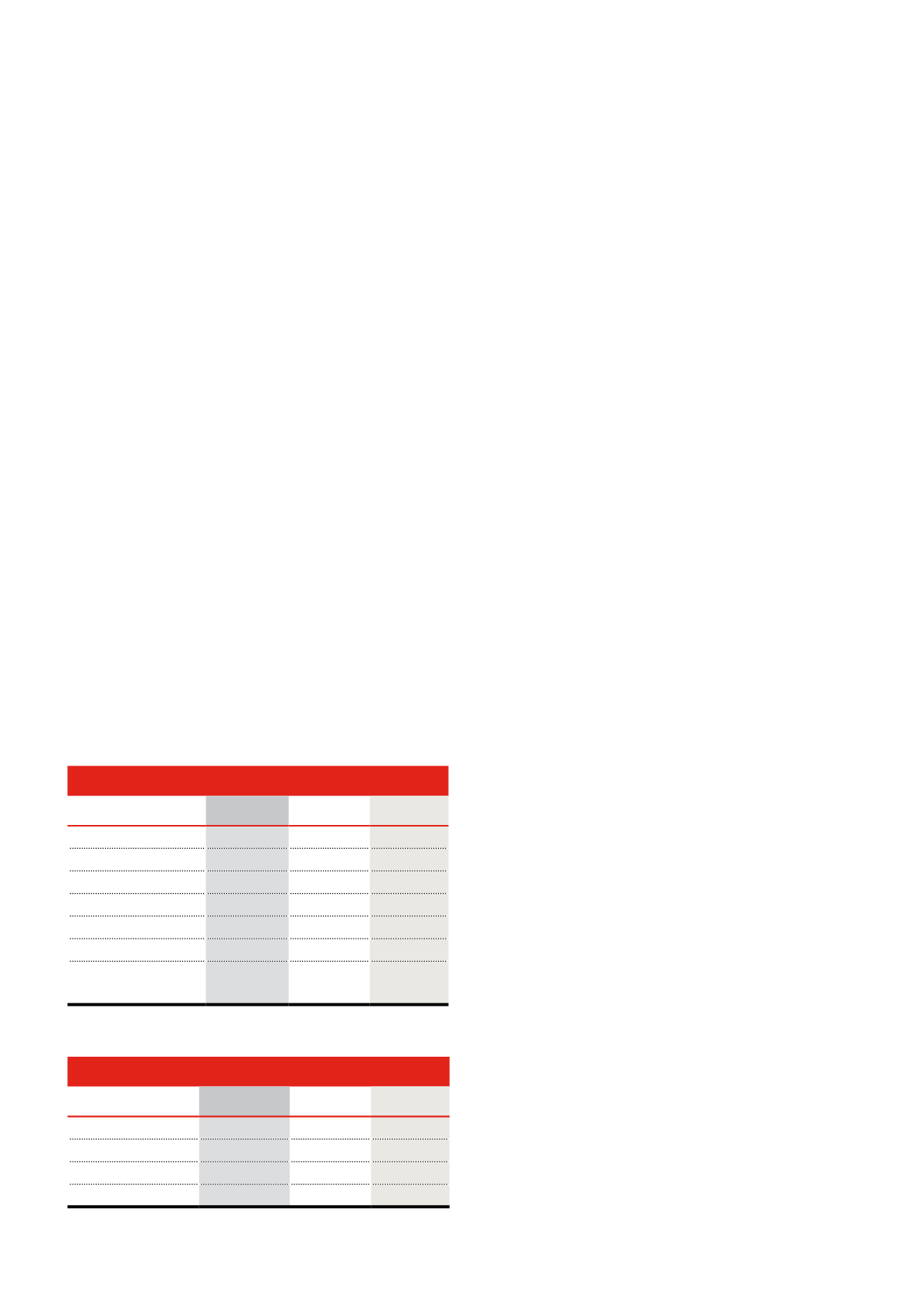

Highlights of the results

Income Statement

In Nigerian Naira

H1 2015 H1 2014 %Change

Gross Earnings

166.9 billion 138.2 billion 21%

Net Operating Income 108.7 billion 90 billion

21%

Operating Expenses

69.6 billion

61.1 billion 14%

Profit Before Tax

39 billion

28.9 billion 35%

Profit After Tax

32 billion

22.9 billion 40%

Cost to Income Ratio 64%

67.9%

Return on Average

Equity

22.3%

19%

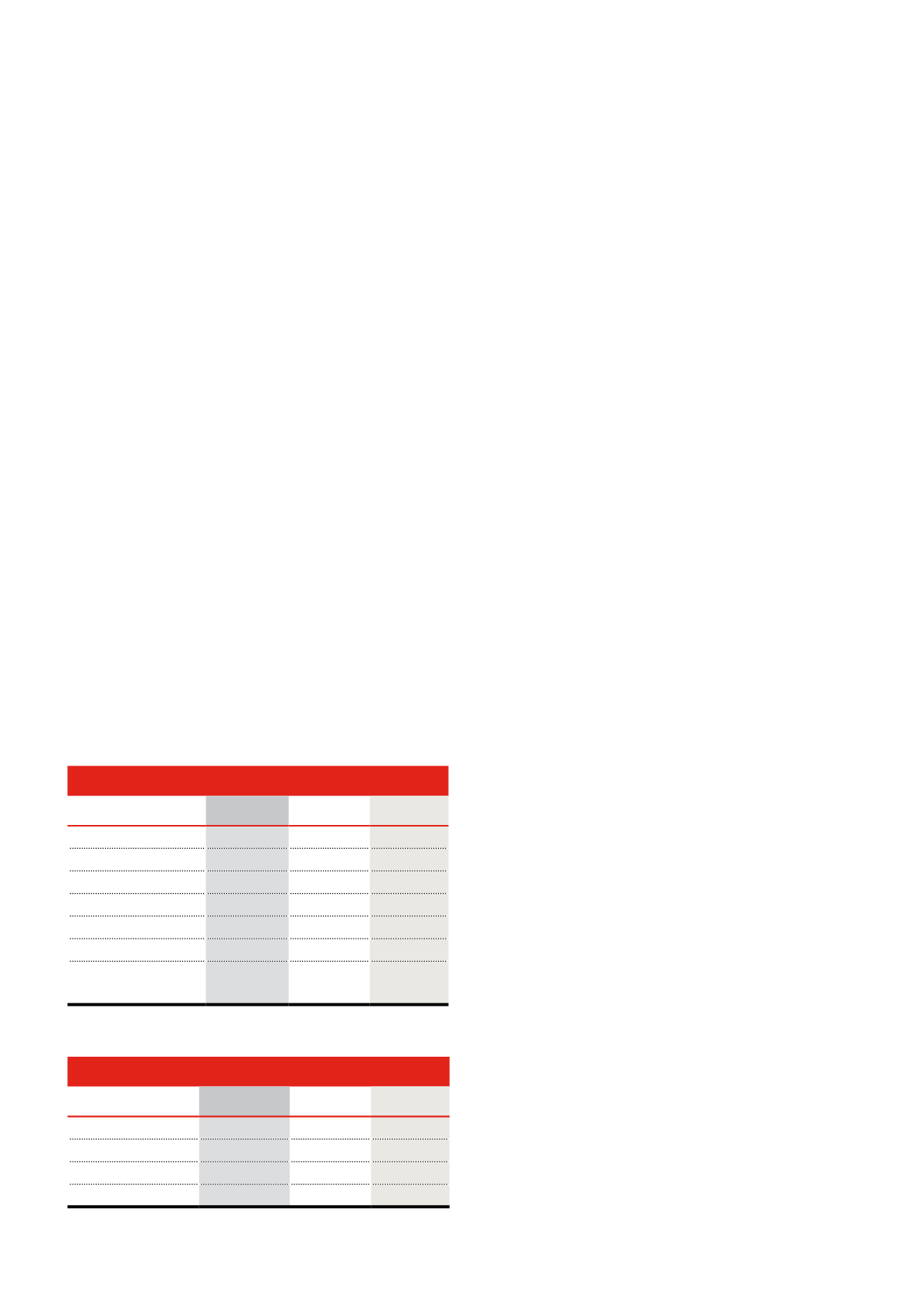

Balance Sheet Figures

In Nigerian Naira

H1 2015

H1 2014 %Change

Total Assets

2.93 trillion

2.76 trillion 6%

Loans and Advances

1.16 trillion

1.07 trillion 9%

Customer Deposits

2.23 trillion

2.17 trillion 3%

Shareholder Funds

307.6 billion

265.4 billion 16%

UBA’s 40% Profit Rise

Outperforms Market

Expectations

Milestone

|

UBA’s 40% Profit Rise Outperforms Market Expectations

What UBA’s GMD/CEO said about the bank’s

performance

“This result has been achieved in spite of a challenging

operating environment. Our business strategy has proved

to be resilient, balancing prudence, with an ability to signifi-

cantly grow bottom line and continue to focus on operating

effectiveness. We look forward to continuing to support our

customers and working with them to achieve financial suc-

cess for them and the wider Nigerian and African econo-

mies,” said Phillips Oduoza, Group Managing Director/CEO.

Financial Analysts Comments

CSL Stockbrokers

Analysts at CSL stockbrokers while reaffirming their “Buy”

rating on UBA stocks and a target price of N7.20, noted that

based on the half year results, UBA is likely to surpass the cur-

rent profit and earnings forecasts.

Chapel Hill Denham

Analysts from Chapel Hill Denham were of the view that

some key strategic decisions taken by UBA in the last few

months had brought impressive results, adding that this was

evident from the increased earnings reported by the bank.

“We like the aggressive stance UBA took on expanding its

loan book, which appreciated by 8.5% since the beginning

of the year. We maintain our earnings forecasts, with a tar-

get price of N6.59 and BUY rating on UBA.”

Renaissance Capital

Analysts at Renaissance Capital noted “UBA’s numbers

read well versus our estimates. We note that profit before

tax growth in the second quarter of 2015 was supported

by a decent topline growth, and a decline in impairment

charges, down by 51%.” The investment banking firm reaf-

firmed their “Buy” rating on UBA stock with a target price of

N8 per share.