July - September 2016 •

The Lion King

• 45

#SUMMERCRUSH |

LIFESTYLE

THE DRIVE FOR INCREASED CUSTOMER SATISFACTION |

A UR

THE DRIVE FOR

INCREASED CUSTOMER

SATISFACTION

BY BABS OLUGBEMI

C

onsumers of financial services

and products are demanding

more engagement than ever,

going by the recent customer service

survey and rating of banks by the

KPMG. The KPMG customer satisfac-

tion survey represents the level and

quality of engagements of the banks

with their customers.

The level and quality of engagement

is the common denominator given the

homogeneous nature of the products

in the banking industry. What set banks

apart are often not the products but

the process and the services involved

in meeting the customers’ needs.

As identified in the report, the three

top reasons a customer will maintain

a bank account are; stability of the

financial institution, image and reputa-

tion, and the quality of service.

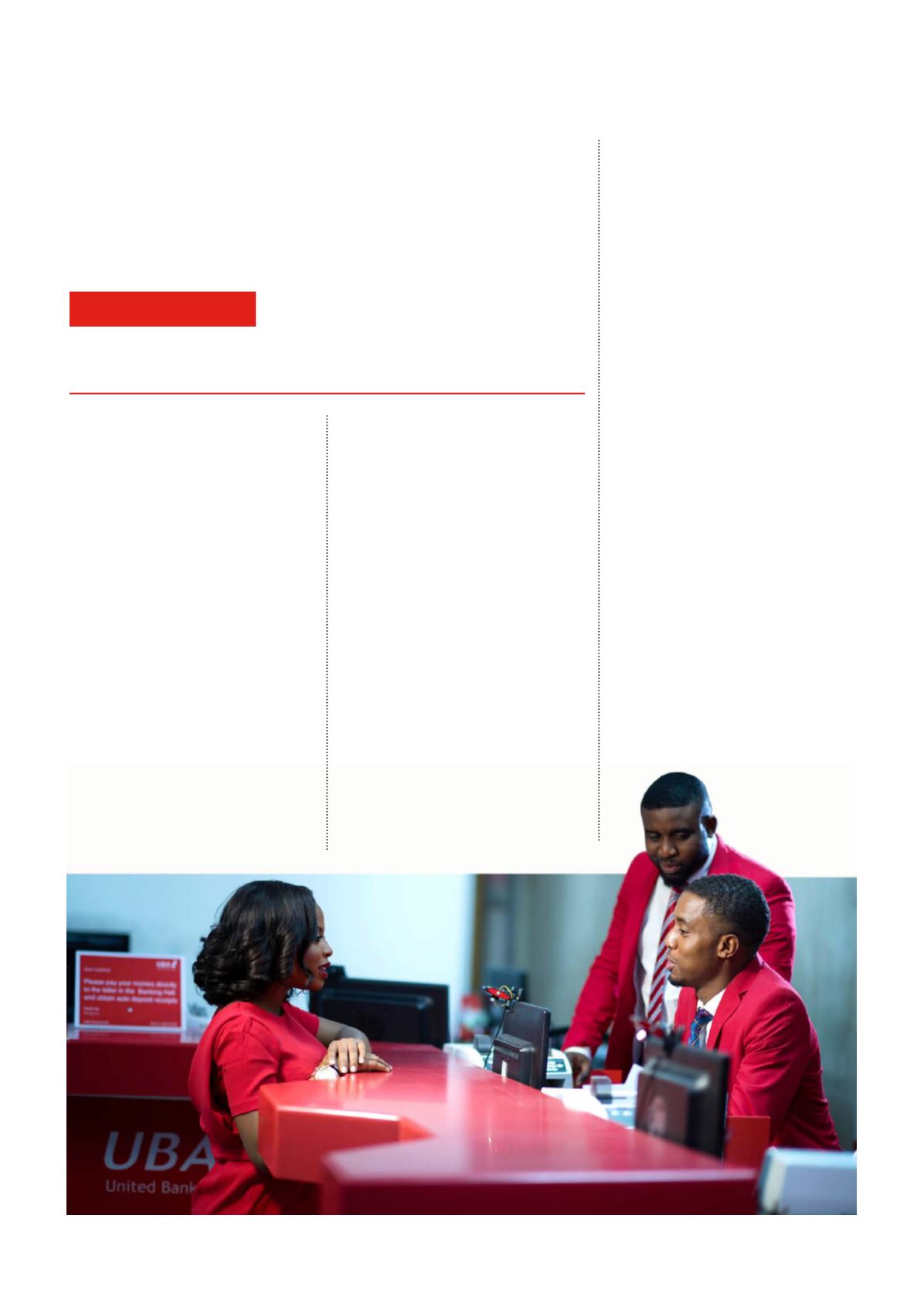

While United Bank for Africa Plc (UBA),

Africa’s global bank, can easily pass

the image and financial stability test,

the bank continues to improve on the

existing customer’s experience and

quality of service. This is why the bank

recently introduced the customer-first

initiative, which has resulted in mile-

stone changes in the bank’s processes

and procedures. With the customer-

first initiative, UBA is renewing its focus

on customer engagement.

LEVELS OF ENGAGEMENT:

The External Engagement

As part of the customer-first initia-

tive, UBA recently sent messages to

all customers introducing to them

their personal relationship managers

to help their day to day interaction

with the bank. Since then, customers

have been calling to make enquiries,

improving the personal engagement

between the bank and the customer.

It has also provided an opportunity to

engage and cross sell the bank’s prod-

ucts as most customers making the

call are retail customers. Customer’s

knowledge of their relationship officers

has improved rapport with relationship

officers, making it easier to resolve

issues, and increased the bank’s wal-

let share of their businesses.

The Internal Engagement

Also the quality of engagement in

the process and service value chain

is a key determinant of the level and

quality of the customers’ experience.

The bank will continue to improve on

the relationship between sales and

operations for effective service deliv-

ery. Operation teams will think and act

like the customers in their approach to

work to support sales.

One key aspect of internal engage-

ment is the communication with inter-

nal customers which will always reflect

in all external engagements. In her

book “Getting Everyone on the Same

Page: Driving the Right Ideas Through

the Corporate Maze,” Ross Lovelock

identified the communication culture

of an organization as an important

factor in driving corporate ideas and

change.

Riding on this platform, UBA is cer-

tainly improving the customer satisfac-

tion rating effectively. The change

required to achieve a superior rating

has been created by the Customer-

First initiative. It is one bank with one

objective - to be the leading custom-

er-focused bank.