January - March 2016 •

The Lion King

• 11

WHY UBA IS A GOOD STOCK TO “BUY” NOW

|

BUSINESS

achieved notwithstanding the chal-

lenging business environment.

He said that it is due to UBA’s resilient

business model, geographic diversifi-

cation, proactive strategies and strong

governance that gave it the perfor-

mance edge in 2015. He assured that

UBA will continue to invest in the future

whilst managing cost tightly to gener-

ate strong returns to shareholders.

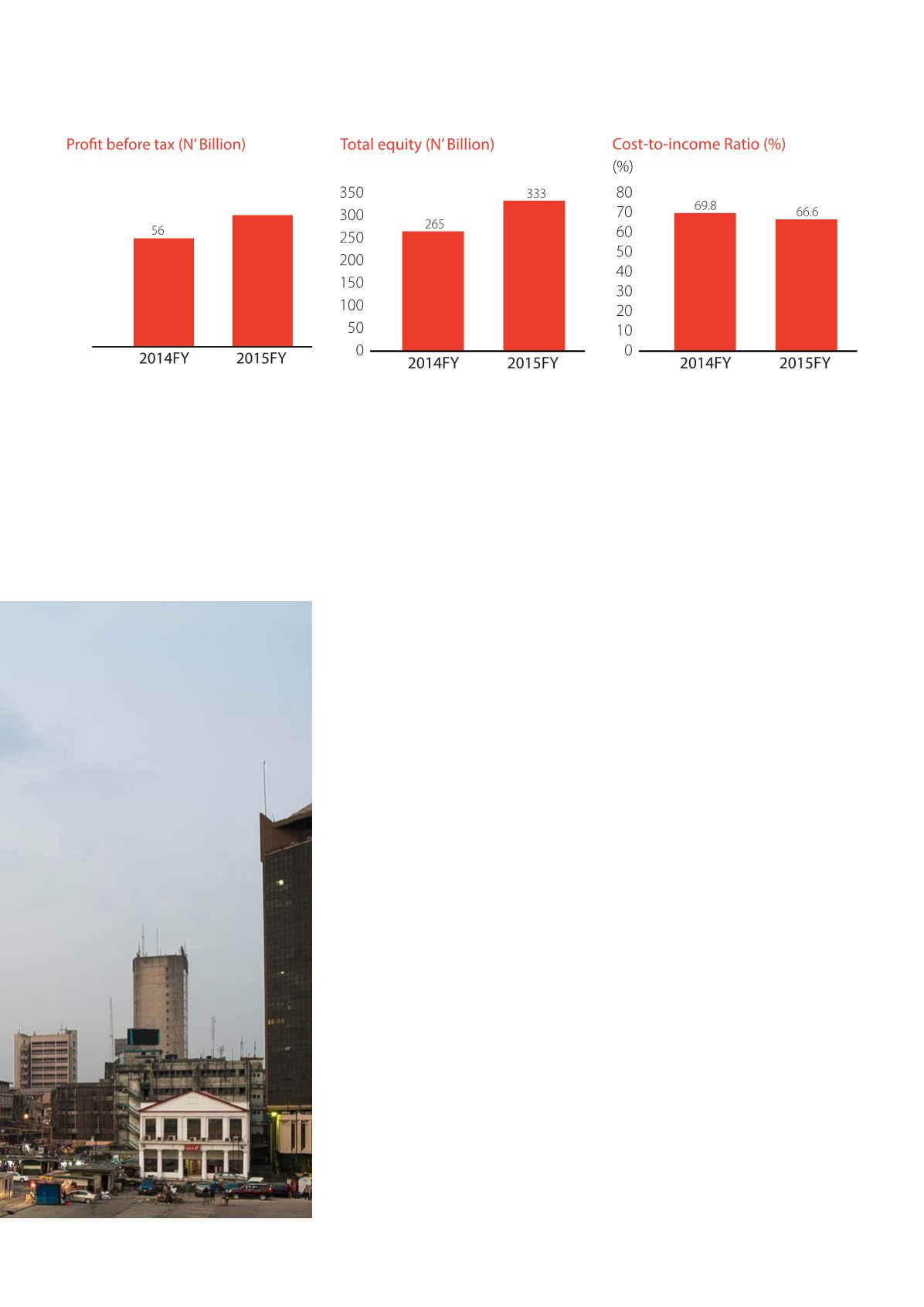

But breaking down the bank’s per-

formance Oduoza noted that UBA

“recorded a decent 10% year-on-year

growth in gross earnings, driven pri-

marily by balance sheet optimization.

With a disciplined approach to cost

management, we achieved a tighter

cost-to-income ratio of 67% and pre-

served earnings growth for our share-

holders. Overall, we grew profit before

tax by 22% to an historic record of

N68.5 billion. More importantly, we

closed the year with a 25% year-on-

year growth in profit after tax to N59.7

billion; impressive performance which

translates to 20% return on average

equity.”

Following the impressive performance,

the board of UBA proposed that a

dividend of 40 kobo per share be paid

to shareholders which brought total

dividend paid for the 2015 financial

year to 60 kobo per share. UBA had

earlier paid an interim dividend of 20

kobo per share.

“Our 2015 profit is a new record and

I am pleased that our performance is

beginning to reflect the hard work and

discipline of our Board, Management

and Staff in creating superior value

for our stakeholders. We remain com-

mitted to growing in a responsible

manner that aligns with our vision of

building an enduring institution” said

Oduoza.

Explaining the significant improve-

ment in the bank’s performance, the

Group Chief Financial Officer (CFO),

Ugo Nwaghodoh said the bank lev-

eraged efficiency gains in business

development and operations to grow

earnings.

“We improved on our balance sheet

management and pricing, thus ensur-

ing a strong 19% growth in interest

income as well as an enhanced net

interest margin of 6.3%. Our improved

service delivery and customized offer-

ings helped in growing transaction

banking volume, with attendant fee

income” Nwaghodoh said.

But what may interest future investors

more is the increasing contribution of

the bank’s African subsidiaries to the

banks earnings.

“I am particularly excited by the per-

formance of our business in Africa

(ex-Nigeria), as we further our synergy

extraction and pursuit of scale eco-

nomics to achieve market share and

earnings targets. Precisely, UBA Africa

contributed 24% of our Group’s profit

before tax in the 2015, despite the

impact of cross-currency depreciation

in some of our markets.”

Nwaghodoh also disclosed that man-

agement’s “prudence and discipline

in risk asset creation over the past

half-decade sustained the quality of

our loan portfolio; NPL ratio stabilized

at 1.7% with full provisions coverage.”

The bank closed the 2015 financial

year with a total assets base of N2.75

trillion, deposits of N2.08 trillion, a loan

book of N1.04 trillion and Shareholder

funds of N333 billion which was 25%

higher when compared with N264 bil-

lion in 2014.

Recently, financial analysts at Nigeria’s

top securities firm, Afrinvest recom-

mended UBA as one of the top stocks

to buy in 2016 citing its “rich return on

equity, lower cost profile and relatively

healthier balance sheet, as positive

driver of earnings and sentiment.”

0

10

20

30

40

50

60

70

80

68