4 •

The Lion King

• October - December 2015

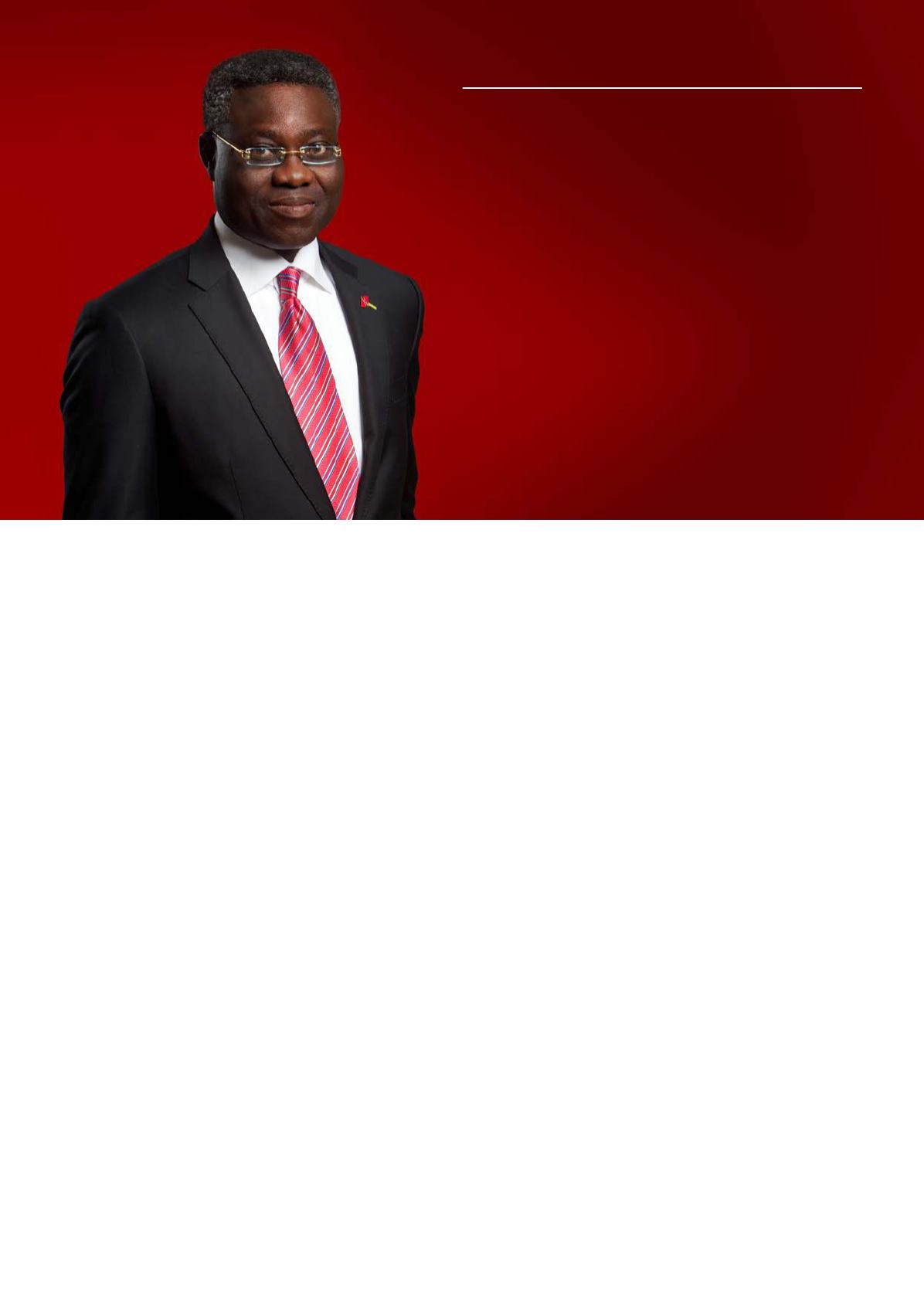

GMD’s Message

rate volatility.

The above scenario will have direct

impact on the banking sector perfor-

mance as non-performing loans are

expected to increase sharply given

depreciating currencies and inter-

est rate volatility. This could further

impact industry market liquidity and

other income lines for banks.

However, I strongly believe that UBA

Group’s strategic focus and our adopt-

ed business model will remain ever

resilient in the face of these challeng-

es. Success of this will be supported

by our continuous investment into key

areas of the Bank, sector focus and

innovative product offerings to our

customers. Pressure on fiscal revenues

arising from weak commodity prices

presents an opportunity to extend our

unique e-payments and collections

solution to public and private sector

customers. At a time many African

governments need to block revenue

leakages, and have efficient and low

cost collection systems, our advanced

e-banking platform offers them an

unrivalled solution. The deployment

of our online and e-banking platforms

and products to private and pub-

lic organizations to track and control

expenditure will improve efficiency in

a tougher business environment envis-

aged in 2016.

UBA has been positioned for a time like

this. Over the years, we have invested

heavily in our IT platforms to ensure

that we have the most advanced

Sustaining the

momentum in

2016

e-payments and collections platforms

as well as online and mobile banking

platforms in the banking industry. And

this is the ideal solution that is needed

now for players in both the public and

private sector. I urge all staff to go out

there to offer our unique solutions to

our existing and prospective custom-

ers. Furthermore, I implore all staff to

ensure that our commitment to excel-

lent customer service delivery remains

our overarching target in dealing with

all customers.

Nevertheless, we must not ignore the

impending risks while growing our busi-

ness group wide. We must continue to

adhere to our strong risk management

practices to create only quality assets.

Finally, let me reiterate that regula-

tory compliance across our operating

environment is the prerogative of

every staff and the Bank remains firm

on zero tolerance to policy infringe-

ments. This is to further build our brand

equity and avoid sanctions.

It is my firm belief that despite all its

anticipated challenges, we have the

resilience, committed staff and right

strategies to make this year better

than 2015 and meet the expectations

of all stakeholders, both foreign and

domestic . I urge you to make 2016

another remarkable and successful

year for the Bank.

Thank you.

Phillips Oduoza

GMD/CEO

T

he 2015 financial year will be

remembered as one that brought

with it both foreign and domestic

macro-economic headwinds, testing

the business models of banks across

the African continent. It was a remark-

able year for UBA Group as we reaf-

firmed the resilience of our balance

sheet and business model to withstand

the significant challenges witnessed

within the African banking industry.

Despite the significant macro and

socio-economic challenges, the

Group recorded stellar performance

as at Q3 2015. Gross earnings record-

ed a year-on-year growth of 17% to

N247bn whilst Profit Before Tax grew

by an outstanding 34.8% to N57.4bn.

This result was attributed to our con-

tinuous staff commitment, our diversi-

fied business structure across multiple

geographies and key growth sectors,

reinforcing the strategic nature of our

business model across Africa.

Looking forward, 2016 has been fore-

cast to present a tougher business

operating environment. Global oil

and commodity prices will remain

depressed in the face of supply glut,

slower growth in China, weak recov-

ery in the Eurozone and more recently,

US Federal Reserve stance to normal-

ize rates. Exchange rates across the

continent have weakened since start

of the year due to slower revenues

resulting from a slide in commodity

prices. This is expected to continue in

2016 and will deepen balance of pay-

ment problems and increase interest