10 | The Lion King

United Bank for Africa:

Facilitating big ticket

transactions on the continent

A

frica’s rising economic power

is getting significant financial

support from one of its biggest

banks, United Bank for Africa (UBA) Plc.

A series of big ticket transactions has

been engineered by the bank either

as lead arranger, co-arranger or major

lending partner showing its strong finan-

cial muscle on the continent.

The deals, which cut across the major

economic sectors of telecoms, power,

oil and gas indicates the bank’s clear

intention to play big in the key sectors

of the economy and ties in with the

bank’s announced intent to dominate

the African banking space. UBA has

subsidiaries in 18 African countries

outside Nigeria.

“We firmly believe that the effect

of these deals will have a sustained

impact on our growth and business”

said Phillips Oduoza, Group CEO, UBA

plc. He assured that UBA remains

focused on its “aspirations of being the

leading financial services institution in

Africa.”

POWER

UBA played a key role in Nigeria’s

power sector privatization.

Some of the major deals include:

KANN Utility $122 Million Acquisition

Deal

UBA was the as Mandated Lead

Arranger, underwriting the entire facility

of $122m (N20bn) for Kann Utilities’

acquisition of the Abuja Electricity

Distribution Company to finance the

payment of the 75% acquisition of 60%

equity stake in Abuja Electricity Distribu-

tion Company.

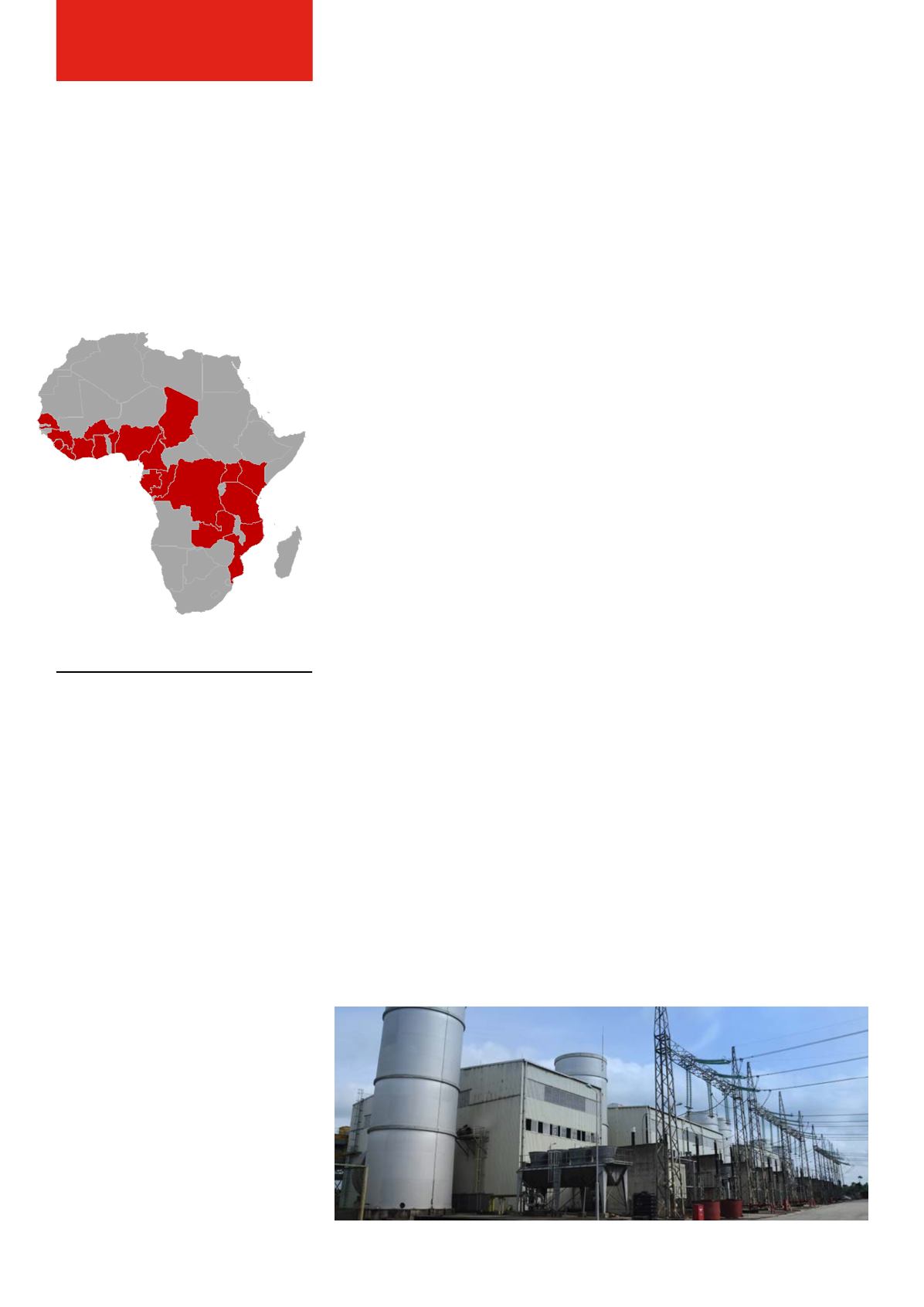

Transcorp’s acquisition of Ughelli Power

Limited

UBA was the Lead arranger taking up

$120m (N19.44bn) of the financing in

respect of Transcorp’s acquisition of

Ughelli Power Plant. The Ughelli Power

Plant has a capacity of 360MW of

electricity with plans by its new inves-

tors, to triple its capacity to 1000MW

over the next 3 to 5 years.

Aura Energy Acquisition of Jos Distribu-

tion Company

UBA acted as Mandated Lead Arranger

and Sole Underwriter for Aura Energy’s

acquisition of Jos Electricity Distribution

Company, raising N9.6 billion to finance

the payment of 75% of Aura’s 60%

equity stake in Jos Electricity Distribution

Company.

Shiroro Hydroelectric Power Plc

UBA successfully arranged debt financ-

ing of US$68m as well as secured equity

investment from a strategic and techni-

cal investors for the acquisition of the

Shiroro Hydroelectric Power Plc by North

Milestones

South Power Company Limited.

USD 35 Million Acquisition of Ibadan

and Yola Distribution Companies

UBA actively participated in the

$35 million syndicated financing for

Integrated Energy Distribution and

Marketing Limited for the acquisi-

tion of Ibadan and Yola Distribution

Companies.

OIL & GAS

Dangote’s $3.3 billion Petrochemical

Deal

UBA Plc joined 11 other banks to

arrange a $3.3billion dollar loan deal

for Dangote Industries Ltd owned by

Africa’s richest man, Aliko Dangote.

The $3.3 billion finance will facilitate the

building of the biggest petroleum oil

refinery as well as a petrochemical and

fertilizer plant in Nigeria. The proposed

largest refinery in Africa is expected

to have a capacity of refining 400,000

barrels of crude oil per day and turn

Nigeria into a petroleum exporter.

Orion Oil Limited $500 million deal

UBA also acted as the co-arranging

bank in a $500m syndicated loan deal

for Orion Oil Limited. The US$500m will

be utilised for the prepayment of crude

oil cargos to be supplied by Société

Nationale des Pétroles du Congo (The

National Oil Company of the Repub-

lic of Congo). The facility comprises

a United States dollar-denominated

$342m tranche and a XAF-denomi-

nated $158m tranche. This transaction

was the largest loan syndication