4 | The Lion King

N

igeria’s new mega-

shopping malls are the fad

in town. Hosting a combi-

nation of cinemas, supermarkets,

fashion shops, it is the place

for Nigeria’s new and aspiring

middle class to window-shop,

shop, or just meet to catch up

on the latest social trends and

business opportunities.

The malls are usually filled to

the brim and on weekends,

the 1000 car parking lot hardly

has a decent parking space.

But Nigeria’s mega malls have

not always been around. It is a

phenomenon that has taken root

in just the last decade. Its rise,

however, says a lot about the

rise of Nigeria’s emerging middle

class and their rising purchasing

power.

Analysts estimate that the

Nigerian consumer market has

attracted more than N200 billion

in the last two years alone as the

success of the earlier shopping

malls drive new investments in

new malls.

The expansion in retail stores is

however not restricted to Nigeria.

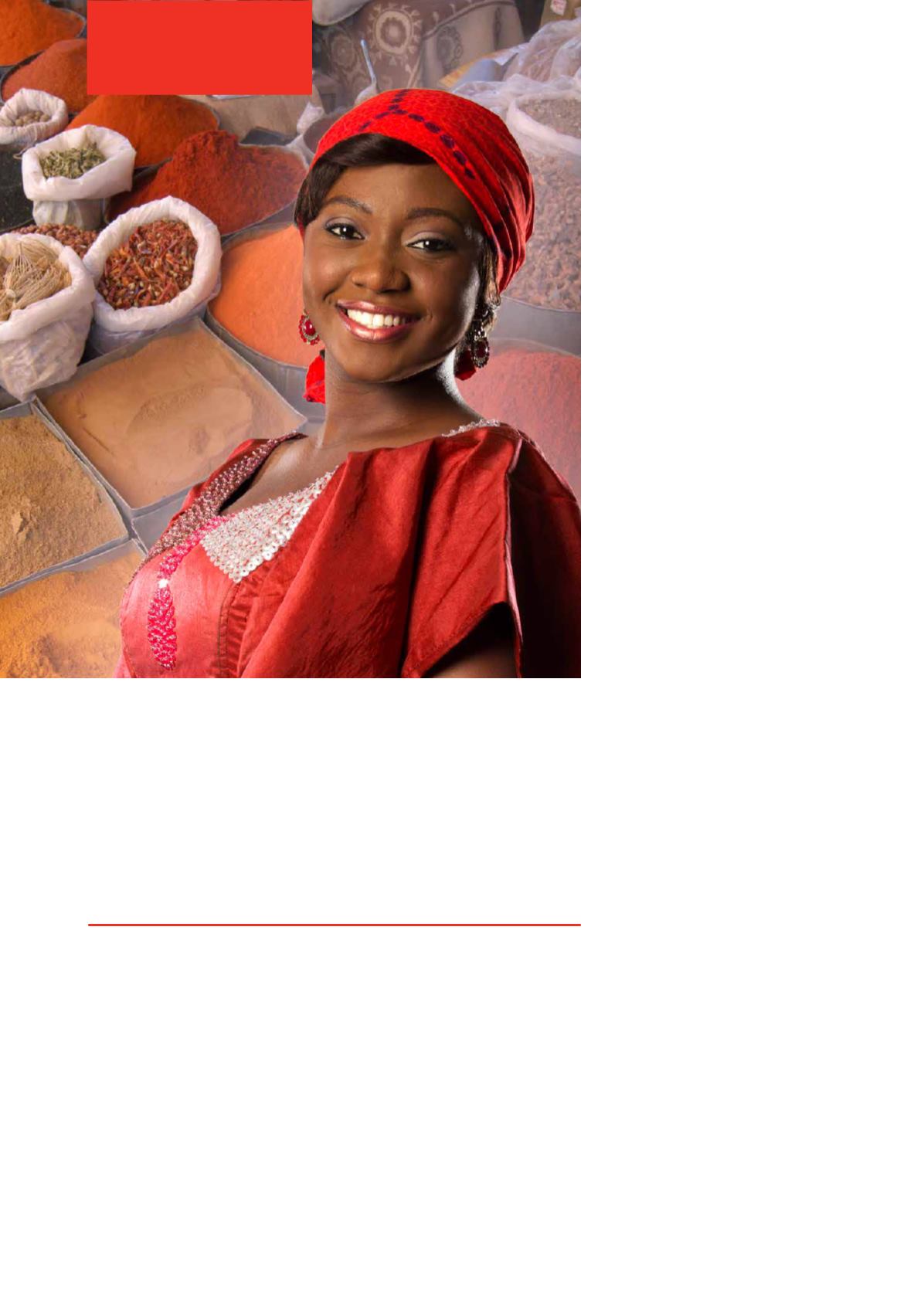

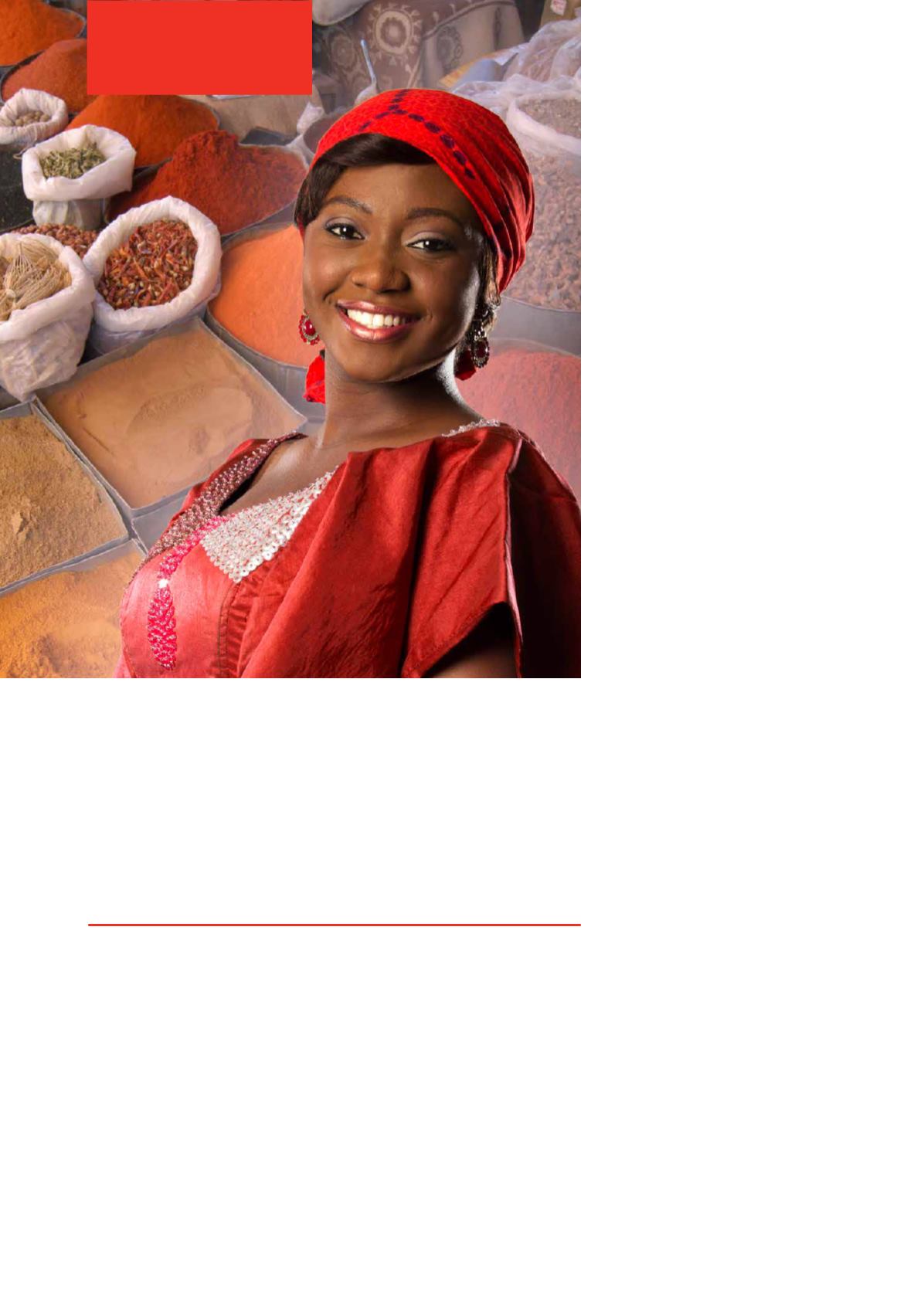

Theme Story

Consumer Market,

The Future?

By Ola Babs-Olugbemi

Across Africa, the mega mall

craze is taking hold. All the

major global retail brands now

see Africa as the next economic

frontier. McKinsey’s 2010 report

on the emerging African conti-

nent estimates that Africa’s

consumer-facing industries will

grow by $400 billion by 2020.

McKinsey notes that Africa’s

consumer industry is the single

biggest opportunity on the

continent.

Giving an insight on the factors

shaping the emergence of

Africa’s consumer class, McKin-

sey cites Africa’s rising popula-

tion, “the fastest growing

and youngest in the world,”

enhanced by its concentration

in urban areas.

The McKinsey Report describes

the new Africa consumer as

having a smaller family with

better education, has a higher

income and is digitally savvy.”

Africa’s above global average

economic growth has led to the

emergence of this high income

consumer class creating a set of

impressive economic data that

is attracting major businesses

into the continent. Foreign direct

investment (FDI) into Africa has

increased from a paltry $9 billion

in 2000 to a high of $62 billion in

2008 but slipped to $56 billion in

2013.

Africa’s collective GDP was

$1.6 trillion in 2008 which was

about the same size of Brazil’s

GDP in 2008 and $2 trillion in

2012. The combined consumer

spending for Africa in 2008 was

$860 billion. Signs of increasing

wealth are seen in the number

of new mobile phone users on

the continent which was 316

million as of 2008 and with 20

African companies making

revenues in excess of $3 billion

annually while increasing urban-

ization has seen a minimum of

52 African cities with a popula-

tion of not less than one million.

The real attraction, however, is in

Africa’s future potential. McKin-

sey estimates that by 2020,

Africa’s GDP would be $2.6

trillion, while consumer spend-

ing will average $1.4 trillion. The

industries that will drive Africa’s