The Lion King | 5

C

onsumer banking, (also

narrowly referred to

in many literature as

Retail banking) is a strategic

division of commercial banks

which enables banks to focus

on individuals (consumers)

rather than on corporations or

institutions. Financial services

packaged for individuals are a

viable banking business which

offers opportunities for growth

and profits. This is even more

important in Nigeria, where a

large percentage of the popula-

tion sits predominantly in the

mass market segment of the

entire banking space. Recent

surveys show that this sub

population is either unbanked

(about 56 Million according to

CBN figures)) or underserved

by the banking sector despite

its huge potentials for stable,

low cost fund and substantial

income potentials.

UBA Plc is strategically

positioned to harness this

huge potential by our offering

of a wide range of products,

services and solutions, tailored

to enhance the customer experi-

ence and ensure that the bank is

a one-stop shop for retail clients

or consumers. To underscore

the bank’s determination to

ensure growth of this segment,

the bank in January 2013

created “The Consumer Banking

Group” with the mandate to

champion this cause and make

the bank the leading institu-

tion by 2015 in meeting the

various needs of individuals and

small businesses. For effective-

ness, the Group is run through

two key Departments: Retail

Products with responsibility for

the Savings Products suite, as

well as remittances (Africash,

Western Union and MoneyGram)

and Consumer credit /Product

developments with respon-

sibility for Credit products,

Current accounts and Product

developments.

Unlike the past, the Consumer

Banking Group is now firmly

responsible for driving the

Product sales through the Bank’s

Relationship Managers (RMs)

and with the support of the

Retail Products Sales teams,

also known as the Electronic &

Personal Banking Sales (EPBS).

These teams interface with

the sales teams at the Business

Offices, the Business Managers

and the Regional Banking Heads

to drive quality and sustainable

consumer experience. The sales

teams are comprised of two

members each in Mass Market,

Mass Affluent and Small &

Medium Business units replicated

in all branches and Business

Offices of the bank. These teams

work together to drive a positive

customer experience and

ensure it is far reaching on all

customer touch points.

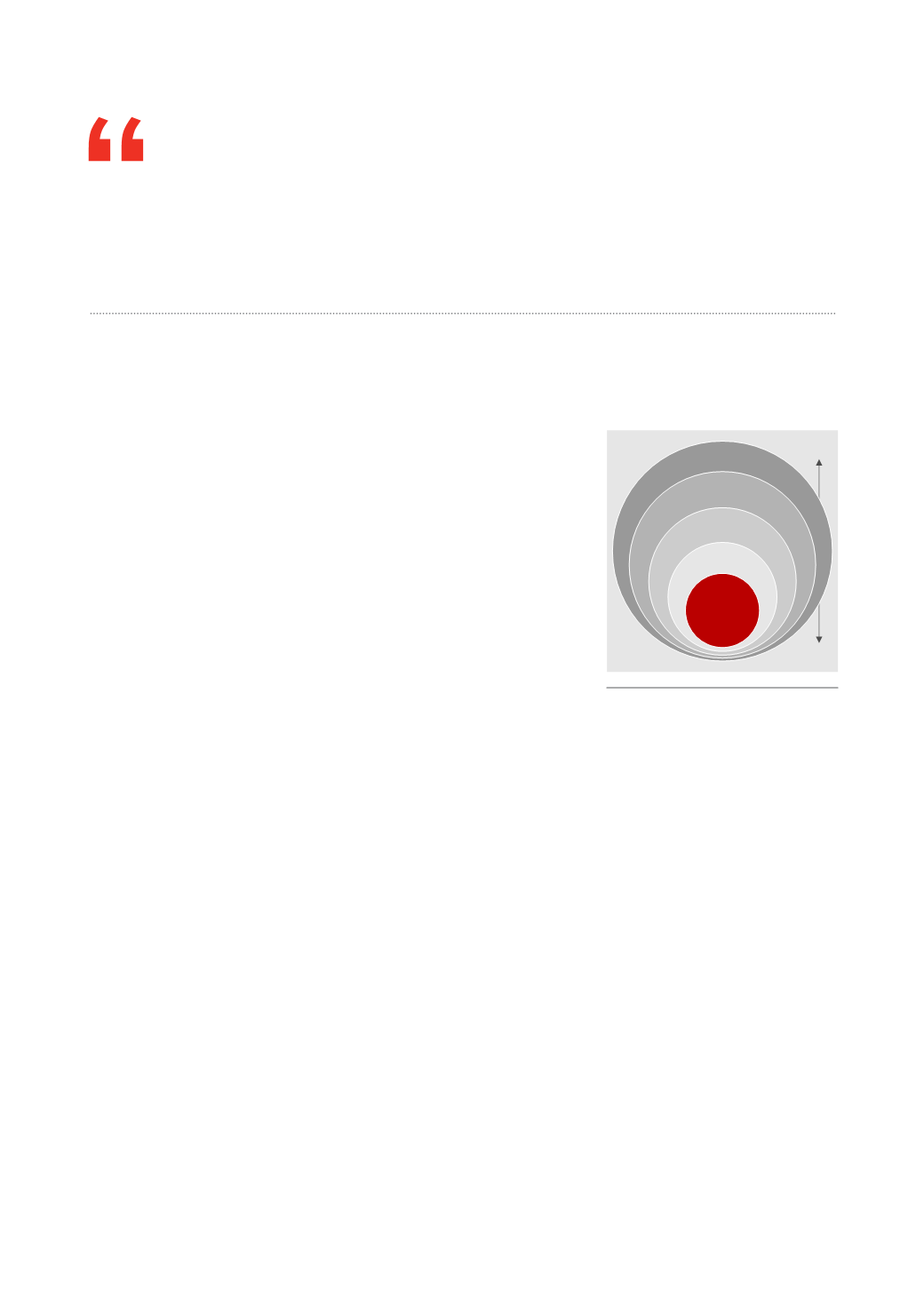

To ensure we stay ahead of

competition, the Retail Product

Development and Manage-

ment team (the group think

tank), is mandated to deliver

on the four major drivers of

customer experience namely;

Product Expectations, Service

Expectations, Brand and After-

Sales Expectations. The team

anticipates customer needs in all

possible forms, even before they

emerge and seek all possible

ways of exceeding such custom-

er expectations. It is through

this team that the group hopes

to remain proactive in product

strategy, product development

and product positioning through

regular competitive analysis and

product research. This is depict-

ed in the diagram shown below:

Drivers of Enhanced Customer

Experience

To further enhance customer

service and experience, we

also deliver a broad range of

products to our largely diversi-

fied customer base, through

our wide branch network,

ATMs, cards solutions, mobile

and internet banking solutions.

Our unique bouquet of retail

products seeks to exceed the

growing expectations of our

esteemed customers and to

continually reach out to the vast

population of the unbanked

by supporting them in build-

ing a financially secure future.

This we have started with the

bank’s variants of Freedom

Accounts (Basic, Medium and

Classic accounts) designed to

adequately cater for this hith-

erto underserved segment. With

the Freedom suite of accounts,

Artisans, Craftsmen, Semi-Skilled,

Unskilled, Traders, Apprentices

and the likes can have banking

accounts with little or no docu-

mentation.

Our U-Gold Savings Account is

By Ilesanmi Phillips Owoeye

Ex

p

s

e

e

l

c

a

t

a

s

r

t

i

o

e

t

n

f

A

x

p

e

E

c

t

t

c

a

u

t

i

d

o

o

n

r

P

x

p

E

e

e

c

c

t

i

a

v

r

t

i

o

e

S

n

p

e

x

c

e

t

a

d

t

i

n

o

a

n

r

B

Customer

Experience

...our offering of a wide range of products, services and solutions,

tailored to enhance the customer experience and ensure that the

bank is a one-stop shop for retail clients or consumers.”